PA Tax Credit Programs

Support Janus Scholarships Through EITC/OSTC Tax Credits

The Janus School is an approved Scholarship Organization that can accept corporate and individual gifts through the Education Improvement Tax Credit (EITC) and the Opportunity Scholarship Tax Credit (OSTC) programs. Donors can receive a tax credit up to 90% of the value of the donation.

Both programs directly benefit our students by providing financial aid to those who need it most, while OSTC funds assist students from underperforming school districts who attend Janus.

KEY DATES AND DEADLINES

- May 15th to June 30th – Existing donors can renew their EITC/OSTC applications.

- July 1st – Submit your first-time application on the first day the program begins, which is usually on this date.

We would love to talk with interested businesses and individuals, but we also encourage you to speak with your tax preparer regarding eligibility.

Hear more details from Tami Clark, Executive Director at Central Pennsylvania Scholarship Fund

Individuals who want more information about the process can watch the EITC Scholarship Program Webinar playback. In this webinar, Janus donors also share their personal experiences with the program!

If you have questions or would like additional information, contact:

Director of Development

717-653-0025

development@thejanusschool.org

EITC/OSTC GIVING PROCESS

Who Can Participate?

Any business or corporate organization operating in Pennsylvania who is subject to one or more of the following taxes:

- Corporate Net Income Tax

- Subchapter S Corp./Personal Income Tax

- Bank & Trust Company Shares Tax

- Title Insurance Company Sales Tax

- Insurance Premiums Tax

- Mutual Thrift Institutions Tax

- Capital Stock Franchise Tax

Any individuals who pay $3,500 or more in state taxes are eligible to donate through a Special Purpose Entity (SPE). Our current SPE partner is the Central PA Scholarship Fund (CPSF).

How to Apply?

Eligible businesses or corporate organizations:

- For the business application guide and timeline, click here to visit the Pennsylvania Department of Community and Economic Development (DCED) website.

- After reviewing the business application guide, submit your application electronically to the DCED.

- You receive confirmation of your eligibility to participate.

- Complete the Designation Form to name Janus as the recipient of your gift.

- Mail your check to:

The Janus School

Attn: Development Office

205 Lefever Rd.

Mount Joy, PA 17552 - The Janus School sends you a letter of acknowledgement that you submit to the state for tax credit.

Individuals who pay $3,500 or more in PA taxes:

- Click here to read a Donor Guide that will give you step-by-step instructions.

- After you read the Donor Guide and determine that you want to apply, click here to fill out the Joinder Agreement and send it to:

- Central PA Scholarship Fund

Attn: Mrs. Tami Clark or Mr. Randy Tarpey

227 Jefferson Avenue

Tyrone, PA 16686

If you have questions or need more information, contact Tim Steffen, Director of Development, at tsteffen@thejanusschool.org.

Connect with The Janus School

Have questions about tax credit programs? We are here to help. Submit the form below and a member of the team will be in touch to provide additional information.

Ways to Give

The following ways to give make a lasting impact on the lives of our students:

- Annual Fund Donation – The Annual Fund provides funding for need-based scholarships, technology upgrades, hands-on experiences, and professional development.

- Endowment Fund Donation – Leave your legacy by investing in the future of The Janus School. Endowment gifts are long-term investments that contribute to Janus’ financial stability, serving as a dependable source of funding.

- Douglas Atkins Scholarship Fund – In honor of Douglas Atkins, our first visionary executive director, your gift to this scholarship fund provides financial assistance for students, helping to ensure tuition is not an obstacle to achieving academic excellence.

- Donor Advised Funds (DAFs) – A personal, tax-efficient way to create a giving account where your gift can grow, tax-free, and be granted to charities of your choice, now or in the future.

- Planned Giving – As part of your financial and estate planning, your planned gift makes a Janus education available for generations to come. Donors receive benefits from tax reductions, while including Janus in wills, trusts, insurance policies, retirement plans, and more.

- PA Tax Credit Programs (EITC & OSTC) – Businesses and individuals can receive 75% to 90% of their charitable gifts as a tax credit, while their donations directly benefit students through financial aid. Learn more about the Special Purpose Entity process and Central PA Scholarship Fund.

- Fundraising Events & Sponsorships – Stay up to date with our fundraising events and sponsorship opportunities happening throughout the year. Donor support helps raise critical funds for our academic programs and provides financial aid to students in need.

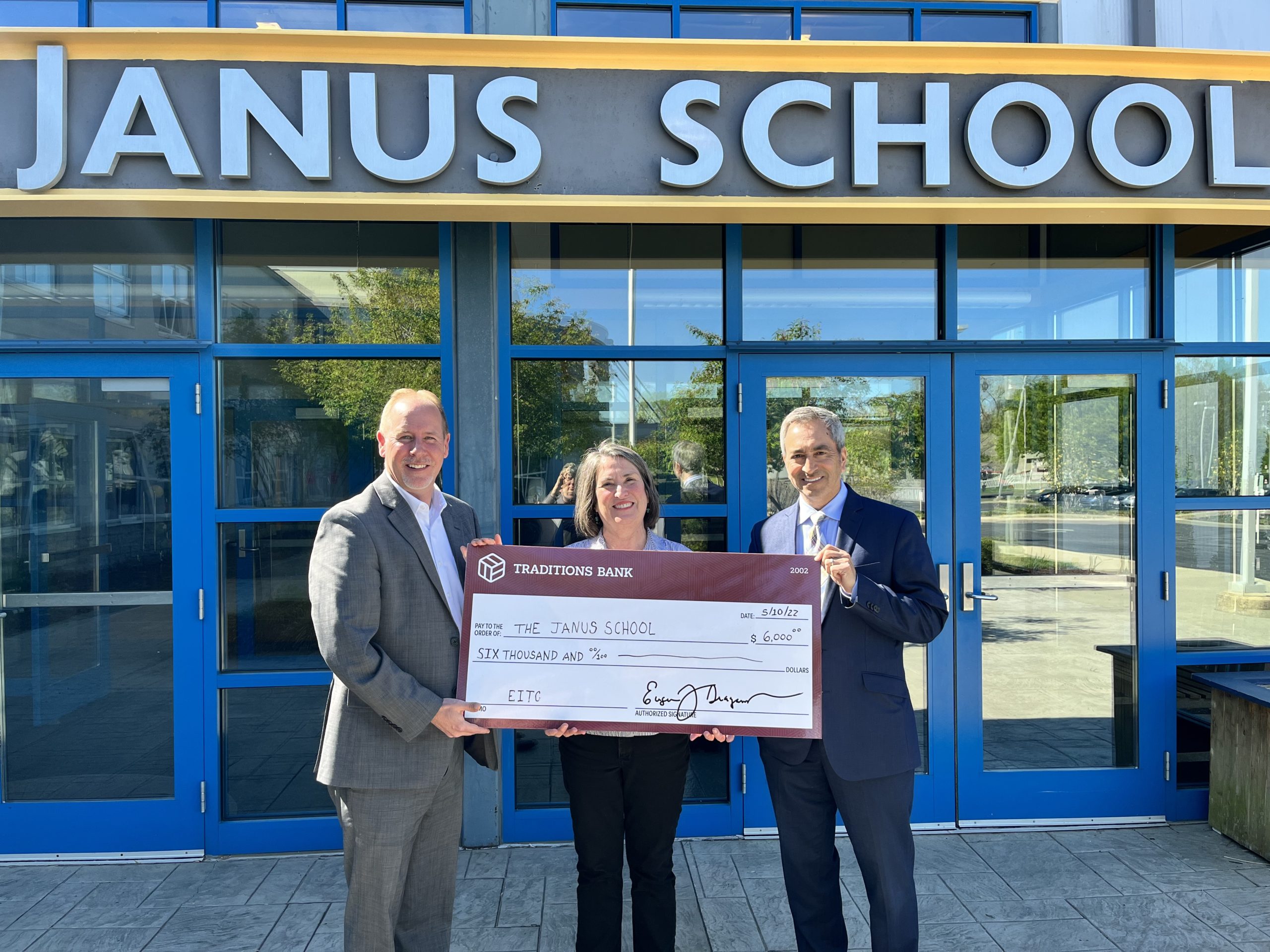

Thank you to our community sponsors!